All education committee hearings in South Carolina should open with staff placing flags on a map marking the states that adopted new choices in K-12 education since the last meeting. It likely would add a sense of urgency to lawmakers’ deliberations.

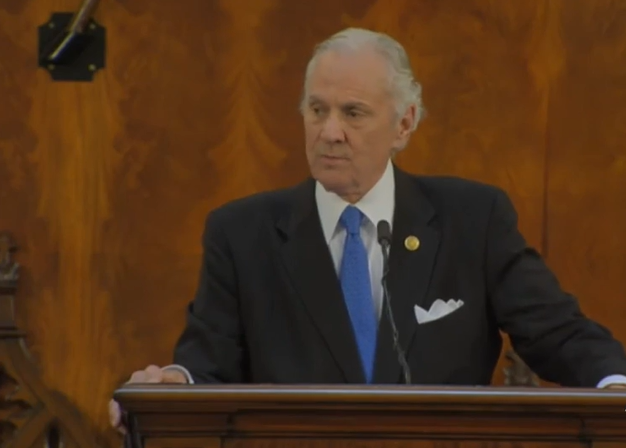

There has even been activity since Gov. Henry McMaster’s State of the State address at the end of January, where he called specifically for the creation of education savings accounts. Since then, lawmakers in both Iowa and Utah have approved flexible account-style options for every student in their states.

Over the last two years, lawmakers in states such as Indiana, Missouri, New Hampshire, and West Virginia also have created accounts. Legislators in Texas, Oklahoma and Florida, to name a few, are now considering similar proposals, with Rep. Byron Donalds, a Republican, representing Florida congressional District 19 in southwest Florida, and former Education Secretary Betsy Devos among those signing an open letter to Florida lawmakers in support of a proposal to expand the state’s existing private learning options.

South Carolina lawmakers entered the session with momentum from last year after a proposal nearly crossed the finish line. But they need to make sure the details that helped derail last year’s proposal do not stall the current proposals.

For example, lawmakers need to specify that the new “education scholarship trust fund” refers to the state’s office that will operate the new accounts, while “education savings accounts” refers to individual student accounts. Technical details like this in the proposal may mean the difference between well-functioning accounts and language that gets mired in litigation (or stalls before implementation).

The proposal’s provisions should clarify that, while parents must sign a contract with the state to use an account, they are then free to choose providers for their children. Parents do not need a contract saying they will follow state rules governing private education providers.

Students should be allowed to access individual public education services such as classes or extracurricular activities, but students should not be allowed to attend a public school full-time and receive an account to use for other education expenses. This would result in taxpayers paying twice for each account student, once for the cost of a public school and then again for the account.

To date, lawmakers have appropriately included criminal background check requirements for participating education vendors, but these requirements should apply only to individuals in schools, tutoring centers, and other educational settings who deal directly with students or have access to student information.

Lawmakers should not put new requirements such as background checks on companies that build computer hardware or print books as these may steer these vendors away.

Account programs that have operated for many years elsewhere in the country can offer best practices for South Carolina: state policymakers should create a rolling application period that allows families to apply throughout the year; student eligibility can be verified using existing state procedures without creating new requirements; and families should be able to use account funds to pay for services related to diagnosing a child with special needs.

Lawmakers have still another alternative: Since 2013, South Carolina has been home to a small private school scholarship program that has strict limitations on student eligibility and the number of scholarships that can be awarded each year.

Yet similar education options funded through charitable donations to scholarship organizations in states such as Florida and Arizona now serve some 200,000 students between them. These are some of the largest choice programs in the country thanks to inclusive rules around student participation and program size.

South Carolina policymakers are considering a new tax credit scholarship opportunity for students. Lawmakers should allow every child to participate and offer families the chance to pay for a variety of education products and services outside of private school tuition, a feature in the current education savings accounts proposal. Students could use the tax credit accounts to choose a private school or families could customize their child’s learning experience.

And the need has never been greater. Research from the state’s Education Oversight Committee during the pandemic noted lower student scores in reading and math. A more recent analysis showed that the percent of middle and high schools labeled “below average” or “unsatisfactory” increased from 2019 to 2022. Every child deserves the chance for a great education, so every South Carolinian should be concerned with these results.

All these things should encourage lawmakers to straighten out the details in education choice proposals this year so they can add South Carolina to the list of states that prioritized student needs in 2023.